Checking Accounts best suited for you

by Admin | July 28, 2021

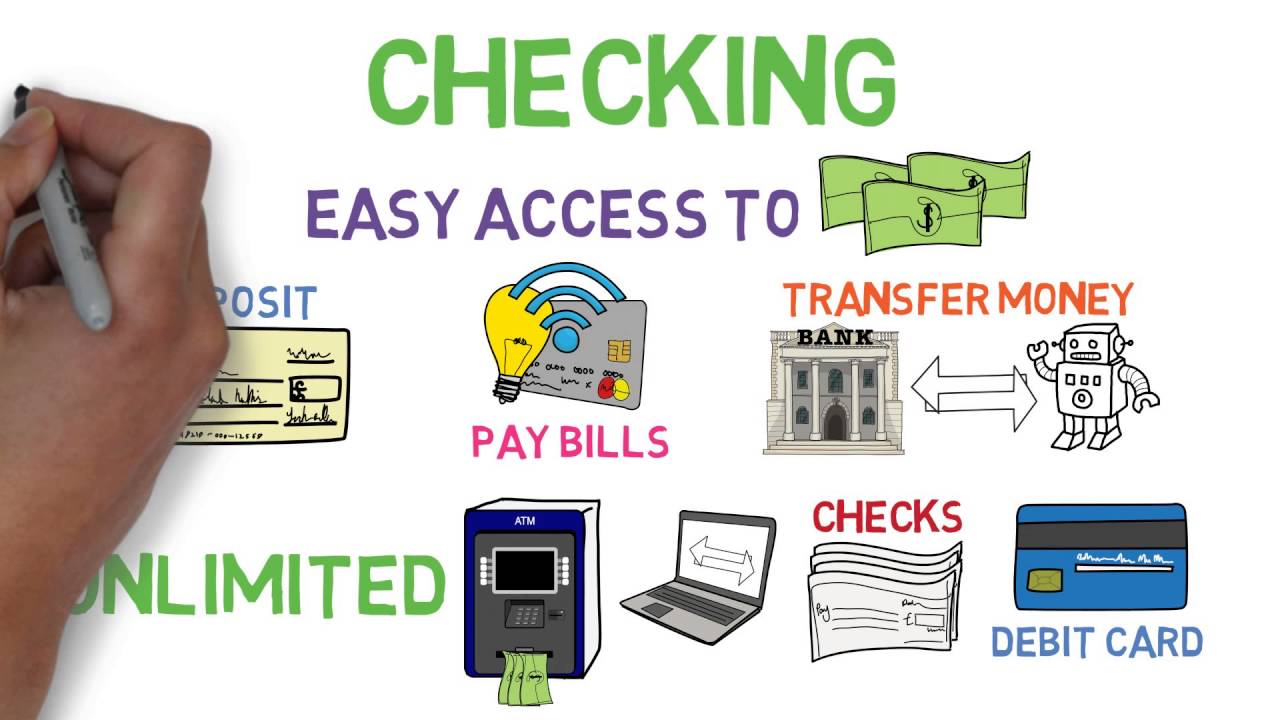

What is a checking account and what is it for?

It is a type of bank account that is characterized by offering low profitability, since the interest rate is almost zero. The advantage of checking accounts is that they allow banking operations; for example, it is possible to make transfers, direct deposit your paycheck, pay bills or link credit or debit cards.

Although most checking accounts will not pay you much interest, there are exceptions of remunerated checking accounts although these usually require you to direct deposit your salary with the bank in order to offer the best interest rates.

Types of checking Accounts

There are a multitude of checking accounts and not all of them offer the same benefits, so I will review the most common ones, their benefits and the ones we recommend for your needs.

Checking Accounts and ATMs

More and more banks are closing more and more branches and ATMs, the reality is that most customers do not go to the office enough or withdraw money enough times a month to maintain these infrastructures.

In fact, in a study we have seen that the preferred method of banking with banks is internet banking.

No fee checking Accounts

The banking business has changed quite a bit in recent years and due to low interest rates, banks no longer make as much profit from their traditional business; lending money to their customers at a higher interest rate than they borrow it. That is why banks are now trying to charge more fees to compensate for this loss of income.

Is this fair? It depends on who you ask, but in general we end customers are not very happy when we have to pay commissions.

Payroll Accounts - checking or interest-bearing Accounts?

These are checking accounts since they allow you to operate and have your money available at any time. But these are characterized by offering more advantages than traditional current accounts.

Normally they do not charge you commissions for almost nothing, but what is really interesting is that some of them offer high profitability for your money.

But of course, if you want something, it costs you something, and that is why the bank will ask you to link up with them and have your salary, pension or unemployment benefit paid directly into your account.

Accounts without a salary

Not everyone has a salary with which to access the best offers or simply do not want to direct deposit your salary. In these cases you can open an account that does not require your salary.

You have to take into account that many of these checking accounts carry commissions. However, if you decide to open an online account you can find accounts that do not require direct deposit of your salary and will not charge you commission.

Online Accounts

The internet boom has affected just about everything: how we make money, how we shop and even how we bank. If using the internet is not a challenge for you and you don't want to stand in line at your bank, this is the best option.